2025海玥黄浦源(售楼处电话)首页网站-海玥黄浦源售楼处地理位置-海玥黄浦源_户型图_价格_海玥黄浦源容积率_楼盘简介_小区环境_户型配套

扫描到手机,新闻随时看

扫一扫,用手机看文章

更加方便分享给朋友

海玥黄浦源售楼处电话:400-891-9910

上海海玥黄浦源售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

该地块多年前就被上海建工取得,此前已经完成上海新昌城部分地块的开发。但1号、7号地块因拆迁工作持续到现在才完成,近期终于正式进入开发阶段。

上海海玥黄浦源售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

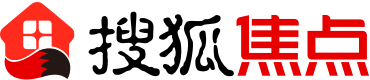

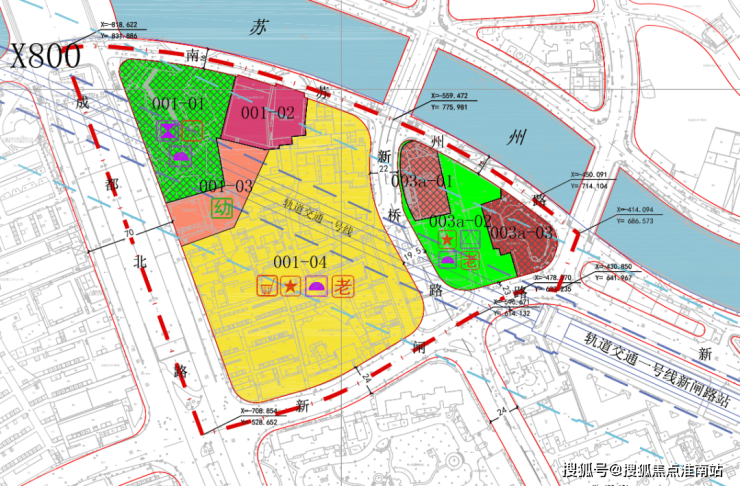

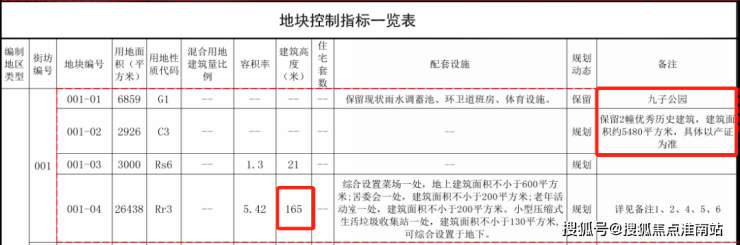

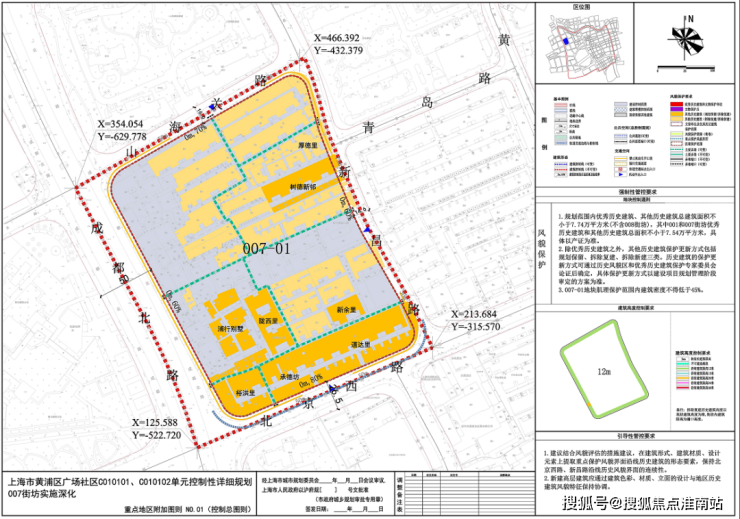

地块规划示意图地块的开发方案已正式公布:规划住宅面积18.2万㎡,商业面积2万㎡,总投资额335亿元,1号地块将新建3栋165米的超高层住住宅,7号地块全部是3层以下的历史风貌别墅。

上海全市150米以上的住宅(含规划在建中),也已经增加到了13个!而未来,上海核心区将还涌现一系列的塔尖豪宅+联排别墅的超级豪宅组合,大部分都集中在黄浦区!

上海海玥黄浦源售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

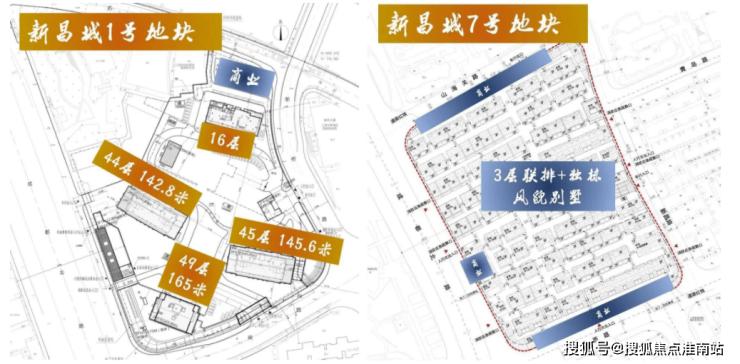

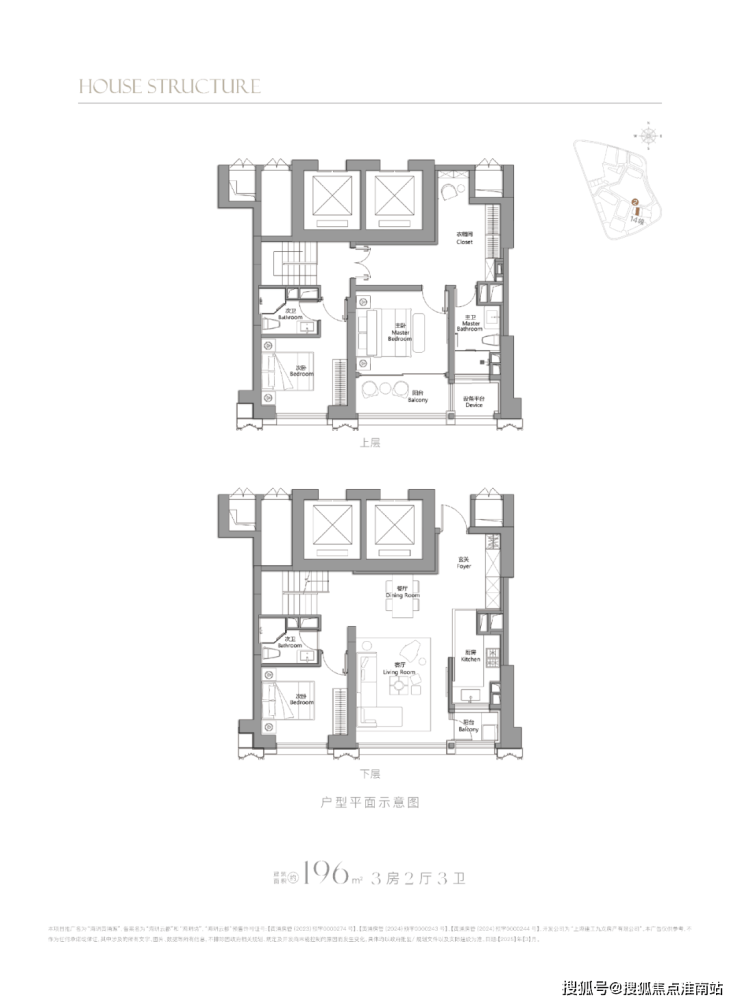

最新户型图如下:

上海海玥黄浦源售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

上海海玥黄浦源售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

一房一价表:

上海海玥黄浦源售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

地块规划方案

上海海玥黄浦源售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

地块的开发方案已正式公布:规划住宅面积18.2万方,商业面积2万方,总投资额335亿元,1号地块将新建3栋165米的超高层住宅,7号地块全部是3层以下的别墅业态!

①新昌路1号地块

地块信息

地理位置:新昌路1号地块分为南北两块:南块,东至新桥路,南至新闸路,西至成都北路,北至成都北路1012弄;北块,东至新桥路,南至新桥路51弄,西至九子公园,北至南苏州路。

新昌路1号地块,将建4栋16-49层的住宅,最高的住宅达到了165米,这是目前上海所有住宅(含规划和在建)中排名第四高,仅次于200米的金桥副中心(在建)、160-192米世茂滨江花园和180米的翠湖天地六期(规划)。

上海海玥黄浦源售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

按照图纸所示,有可能是44层的超高层住宅(以实际为准):

上海海玥黄浦源售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

上海海玥黄浦源售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

西北角是九子公园,还会保留2幢优秀历史建筑。

附新桥路东侧3号地块信息:

项目现场:

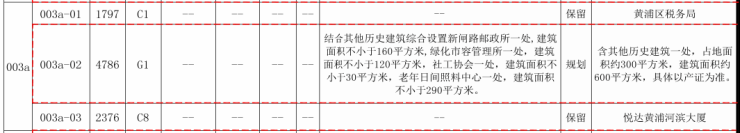

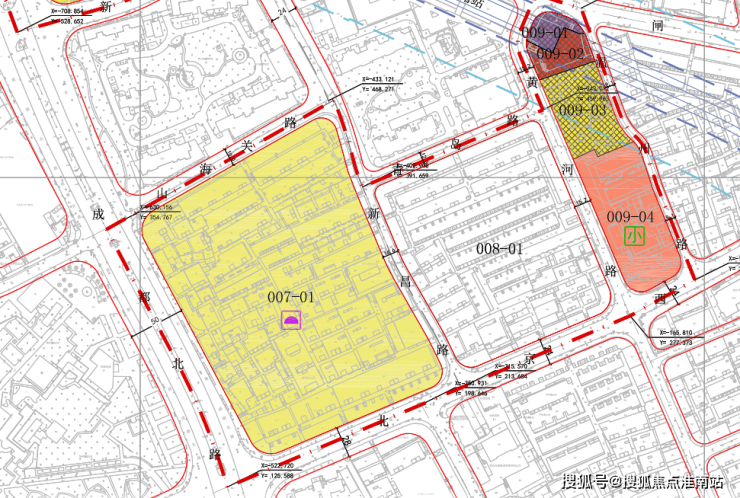

②新昌路7号地块

地块信息

地理位置:东至新昌路,南至北京西路,西至成都北路,北至山海关路。

总用地面积:46089㎡;总建筑面积:178560㎡;其中地上建筑面积:60275㎡,地下建筑面积:118285㎡。

7号地块作为历史风貌保护街坊,建筑限高为12米,大概率为别墅产品。可能是联排+少量的叠墅。

上海海玥黄浦源售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

而且7号地块有非常多的优秀历史建筑,比如浦行别墅、陇西里、新余里、裕洪里、承德坊、道达里等。

规划图

项目现场:

上海海玥黄浦源售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

交通配套:项目周边有1号线新闸路站、13号线自然博物馆站,轨道交通极为便利,自驾方面,项目临近南北高架,附近还有北横通道等快速路高架路,通达市区各地。

商业配套:项目周边有人民广场、南京东路、南京西路等高端集中商圈。

教育配套:项目周边有上海市黄浦区曹光彪小学、上海市格致初级中学等知名院校。

上海海玥黄浦源售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

医疗配套:周边有上海市长征医院、上海市静安区北站医院、上海市静安区中心医院等。

海玥黄浦源售楼处电话:400-891-9910

上海海玥黄浦源售楼处电话☎:400-891-9910【开发商售楼处预约看房热线】(一对一热情vip服务)

The difference in risk and return between stocks and bonds is mainly reflected in the following aspects:

Risk: Stocks typically carry higher risk than bonds. The stock price fluctuates greatly and is influenced by various factors such as the company's operating conditions and market sentiment, which may result in significant losses for investors. In contrast, bonds have clear agreements and guarantees for interest rates and principal recovery, resulting in relatively lower risks.

Yield: Stocks typically have a higher potential for returns than bonds. Although stock prices fluctuate greatly, it also means that higher returns may be obtained. The returns on bonds are relatively stable and limited, mainly coming from fixed interest income and principal recovery at maturity.

Stability: The bond has a predetermined interest rate before purchase, and investors can receive fixed interest at maturity, which provides a stable expected return for bond investors. The dividend yield of stocks is uncertain, and their dividend income fluctuates with the company's profitability.

The difference in risk and return between stocks and bonds is mainly reflected in the following aspects:

Risk difference: Stocks are often considered a high-risk investment tool because their price fluctuations can be significant, which can increase investors' risk. In addition, if the company performs poorly, investors may suffer losses. In contrast, bonds are generally regarded as a low-risk investment tool. The price fluctuations of bonds are usually smaller than those of stocks, so their risk is relatively low.

Yield difference: Stocks generally have much higher returns than bonds. This is because the returns of stocks not only come from dividends, but also from capital gains brought about by the rise in stock prices. The returns on bonds are mainly fixed interest income, which is relatively stable but lower compared to stocks.

Stability difference: Bonds have a predetermined interest rate before purchase, and investors can receive fixed interest at

声明:本文由入驻焦点开放平台的作者撰写,除焦点官方账号外,观点仅代表作者本人,不代表焦点立场。